Do you ever feel confused when it comes to your retirement benefits?

While your non-teaching peers can find tips and tricks for their 401(k) accounts online and specialists who are ready to advise, there is significantly less collective knowledge when it comes to your teachers retirement benefits.

Over a series of posts, I’ll unpack the options available to you and provide some general commentary and pointers. Everyone’s situation is unique, so look at this as an overview of best practices and know that you can reach out if you want to discuss your specific situation.

We start with the TRS, or Teachers’ Retirement System.

What is the TRS?

The Teachers’ Retirement System, or TRS, is your pension. A pension is a regular payment made during a person’s retirement from an investment fund to which that person and/or their employer contributed.

Pensions were the primary method for funding retirement prior to the advent of the 401(k) account in 1978. They are increasingly rare now however as 401(k) plans have shot to prominence.

Within the TRS, you have two options: Plan 2 or Plan 3. If you make no selection during your initial 90-day enrollment period, you will end up in Plan 3.

What are the two plans?

Plan 2 is the traditional pension. You receive a “defined benefit” based on your years of service and salary.

Plan 3 is a two-part plan. You receive a reduced version of Plan 2’s traditional benefit, but you also have access to the value of your contributions and their investment returns. This second part is referred to as a “defined contribution.”

What is the difference?

With a defined benefit plan, you can calculate how much income you will receive in your retirement. The benefit is defined.

With a defined contribution plan, it is the contribution amount that is known, or defined. This is an important distinction, because while you know what goes in, you don’t know what will come out. The result depends on the stock market. If the stock market performs well, the amount you end up with could be significantly higher than a defined benefit plan. Conversely, if the account is mismanaged or the stock market has a series of poor returns, you might end up with less.

A quick note on risk and predatory sales practices

How you feel about stock market risk is important and should be a factor in how you invest your money. What it should not do is allow someone to play on your emotions and sell you a product you don’t need at a price that you shouldn’t have to afford.

Always get a second opinion, make sure you know what fees you will be paying, and don’t let someone scare you into buying something.

The lack of protection for teachers’ retirement programs when it comes predatory sales practices and high fees is a topic important enough that it warrants its own post.

Back to the TRS.

Benefits Calculation of Pensions

The State uses a straightforward calculation to determine your monthly benefit in retirement using Service Credit Years (SCY), Average Final Compensation (AFC), and a benefit percentage of either 1% (Plan 3) or 2% (Plan 2).

The base formulas are:

Plan 2: SCY x 2% x AFC = Monthly Benefit

and

Plan 3: SCY x 1% x AFC = Monthly Benefit

Example: 30 years with a final monthly AFC of $6,000

Plan 2: 30 x 2% x $6,000 = $3,600

Plan 3: 30 x 1% x $6,000 = $1,800 + Defined Contribution Plan Withdrawals

These numbers are adjusted depending on your selection of survivorship benefits and when you retire.

Benefit Vesting

Your contributions to either plan remain yours even if you leave your job prior to retirement. Employer contributions are used to fund your defined benefit.

Plan 2 participants vest (retain the right to their defined benefit at age 65 even if they leave their job) after five years of service credit. If you pull your funds out of the plan when you leave your job, however, you give up the right to your benefit.

Plan 3 participants vest after 10 service credit years. If at least one service credit years is earned after age 44, the requirement drops to five service credit years.

Contributions to TRS Plans

Employee contribution rates for Plan 2 are set by the State and adjusted every two years. Contributions are increasing from 7.77% to 8.05% of your salary in 2021. Your employer also makes contributions on your behalf.

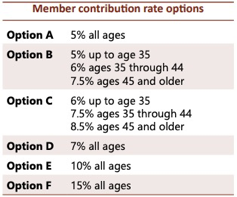

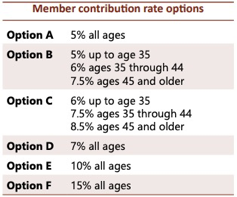

Contribution rates for Plan 3 are set when you enroll in the program. Once selected, you do not have the ability to change this election unless you change employers within the TRS system. The contribution rate options are:

Your contributions and any ensuing investment gains make up the defined contribution portion of your eventual retirement benefit. Your employer’s contributions to the plan make up the defined benefit – or pension – portion of your retirement benefit.

Investment Options:

There are no investment decisions to make for those enrolled in Plan 2. This can be viewed as a perk of the plan by some, a deficiency by others.

Plan 3 enrollees have choices to make.

The first choice is between a Self-Directed Investment Program or the Washington State Investment Board (WSIB) Program.

WSIB

The WSIB provides a Total Allocation Portfolio (TAP) investment option. The TAP is relatively aggressive and has a blend of investment types. Through the TAP, the WSIB can invest in asset classes that are not available to the average investor, or even the self-directed investor (explained below). It is worth noting that investors have no control over the allocation of the TAP. A 25-year-old and a 65-year-old will have the same portfolio allocation.

The TAP investment option costs 0.4792%. Meaning, if you invest $100,000 into the TAP option, the WSIB will charge you $479.20 annually. Ideally, this is more than made up for by the investment returns of your portfolio.

Always look at the cost, aka expense ratios, of your investments. Particularly when working with an advisor. It is not unusual to see fund expenses ranging above 1.00%. This is on top of any “loads” or other charges layered onto the investment.

Self-Directed Investments

If you do not want to use the WSIB TAP investment option, you can opt for a self-directed approach. Within the self-directed option you have a choice between investing in pre-determined “target retirement” portfolios that shift their allocation over time and a true do-it-yourself approach.

Target Retirement Date

The Target Retirement (One-Step Investing) approach offers investments that are aggressively allocated for younger investors, and which shift to less aggressive allocations as investors age and their retirement date approaches.

The funds provide a mix of active and passive management. Active management refers to investment funds where fund managers can choose specific companies, sectors, or countries that they expect will perform the best. Active management is typically more expensive than passive management. Passive management refers to investments that are designed to track an index, or category of investments. The goal with passive investing is to provide exposure to, for example, US Large Companies as a whole without making bets on specific companies.

Using the 2050 Retirement Fund as an example, the cost for a target retirement date fund is ~0.12%.

Build and Monitor

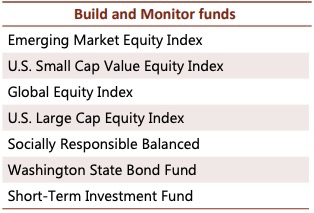

For those who want to take a more active role in their account, the Build and Monitor option allows you to choose from a list of funds and create the allocation that fits your needs. The investment options for this approach are somewhat limited but cover a significant number of the asset classes one might expect to find in a well-diversified portfolio.

Underlying costs for each of the funds vary between roughly 0.01% to 0.09%.

Key Takeaways

So, do you enroll in Plan 2 or Plan 3? Again, the caveat that your situation is unique and I can’t make general proclamations that works for everyone.

That said, I prefer the option that lets the stock market do the heavy lifting for retirement. Yes, there is market risk, but if you’re a new employee looking at 30+ years until retirement, time is on your side. And as retirement nears? Simply shifting your portfolio to a more conservative allocation can help you reduce the amount of risk in your portfolio. All without paying additional fees for expensive insurance products, annuities, or worse.

When would I choose Plan 2? Primarily if I was looking at a teaching career of at least five years but less than ten. This corresponds to the differing vesting schedules. If teaching will be a relatively short-lived career, I’m more interested in the plan that lets me vest in my employer’s contributions earlier.

If you choose Plan 3, there are a few next steps.

Picking a savings rate.

Personally, I’m a fan of Options B and C. Why? Because they encourage you to combat “lifestyle creep” while also increasing your savings rate over time. Win-win. Lifestyle creep is the tendency for our expenses to grow as our income increases simply because the money is there, not because needs have materially changed. Paying your future-self first is a good practice to cultivate.

Could you choose Option A? Yes, the tendency as a planner is to put as much into tax deferred accounts as possible. However, a 5% contribution might fit your budget better. If that is the case, you can plan to use the DCP or another option in the future when you can increase your retirement contributions.

Investments

Maintaining proper diversification and keeping costs low are the foundation of my investment philosophy. Increased complexity often leads to increased costs and a decreased net return, even if the pitch sounded really good.

Yes, you might be wondering, but what if my investment manager beats the market? Those costs can be worthwhile, no? Unfortunately, decades of investment research strongly suggest that your manager is just not going to consistently beat the market. They will, however, consistently charge you the same fee.

So, which portfolio to choose? The TAP portfolio is a solid option, but more expensive than others at 0.48%. The Target Retirement funds offered by the State of Washington are less complex, but also solid offerings and cost effective. I lean towards those as the best option. However, if you are managing your account in conjunction with your overall portfolio, the “DIY” approach could be attractive. In that case, you could choose to pick certain asset classes to hold in your tax deferred TRS account and gain diversification from investments elsewhere as a part of a strategy termed asset location. As a financial planner, this DIY approach is appealing to me, but it is certainly more hands-on and potentially prone to more error than the others.

Next Up

If you found this breakdown of the TRS helpful, be sure to visit once our review of the Washington State Deferred Compensation Program is up. If you have have questions that weren’t addressed or want to talk more specifically about your situation, schedule a free call with us via our “Contact Us” page. Or email me at paul@heritageroadadvisors.com. We offer 30 minute

Do you ever feel confused when it comes to your retirement benefits?

While your non-teaching peers can find tips and tricks for their 401(k) accounts online and specialists who are ready to advise, there is significantly less collective knowledge when it comes to your teachers retirement benefits.

Over a series of posts, I’ll unpack the options available to you and provide some general commentary and pointers. Everyone’s situation is unique, so look at this as an overview of best practices and know that you can reach out if you want to discuss your specific situation.

We start with the TRS, or Teachers’ Retirement System.

What is the TRS?

The Teachers’ Retirement System, or TRS, is your pension. A pension is a regular payment made during a person’s retirement from an investment fund to which that person and/or their employer contributed.

Pensions were the primary method for funding retirement prior to the advent of the 401(k) account in 1978. They are increasingly rare now however as 401(k) plans have shot to prominence.

Within the TRS, you have two options: Plan 2 or Plan 3. If you make no selection during your initial 90-day enrollment period, you will end up in Plan 3.

What are the two plans?

Plan 2 is the traditional pension. You receive a “defined benefit” based on your years of service and salary.

Plan 3 is a two-part plan. You receive a reduced version of Plan 2’s traditional benefit, but you also have access to the value of your contributions and their investment returns. This second part is referred to as a “defined contribution.”

What is the difference?

With a defined benefit plan, you can calculate how much income you will receive in your retirement. The benefit is defined.

With a defined contribution plan, it is the contribution amount that is known, or defined. This is an important distinction, because while you know what goes in, you don’t know what will come out. The result depends on the stock market. If the stock market performs well, the amount you end up with could be significantly higher than a defined benefit plan. Conversely, if the account is mismanaged or the stock market has a series of poor returns, you might end up with less.

A quick note on risk and predatory sales practices

How you feel about stock market risk is important and should be a factor in how you invest your money. What it should not do is allow someone to play on your emotions and sell you a product you don’t need at a price that you shouldn’t have to afford.

Always get a second opinion, make sure you know what fees you will be paying, and don’t let someone scare you into buying something.

The lack of protection for teachers’ retirement programs when it comes predatory sales practices and high fees is a topic important enough that it warrants its own post.

Back to the TRS.

Benefits Calculation of Pensions

The State uses a straightforward calculation to determine your monthly benefit in retirement using Service Credit Years (SCY), Average Final Compensation (AFC), and a benefit percentage of either 1% (Plan 3) or 2% (Plan 2).

The base formulas are:

Plan 2: SCY x 2% x AFC = Monthly Benefit

and

Plan 3: SCY x 1% x AFC = Monthly Benefit

Example: 30 years with a final monthly AFC of $6,000

Plan 2: 30 x 2% x $6,000 = $3,600

Plan 3: 30 x 1% x $6,000 = $1,800 + Defined Contribution Plan Withdrawals

These numbers are adjusted depending on your selection of survivorship benefits and when you retire.

Benefit Vesting

Your contributions to either plan remain yours even if you leave your job prior to retirement. Employer contributions are used to fund your defined benefit.

Plan 2 participants vest (retain the right to their defined benefit at age 65 even if they leave their job) after five years of service credit. If you pull your funds out of the plan when you leave your job, however, you give up the right to your benefit.

Plan 3 participants vest after 10 service credit years. If at least one service credit years is earned after age 44, the requirement drops to five service credit years.

Contributions to TRS Plans

Employee contribution rates for Plan 2 are set by the State and adjusted every two years. Contributions are increasing from 7.77% to 8.05% of your salary in 2021. Your employer also makes contributions on your behalf.

Contribution rates for Plan 3 are set when you enroll in the program. Once selected, you do not have the ability to change this election unless you change employers within the TRS system. The contribution rate options are:

Your contributions and any ensuing investment gains make up the defined contribution portion of your eventual retirement benefit. Your employer’s contributions to the plan make up the defined benefit – or pension – portion of your retirement benefit.

Investment Options:

There are no investment decisions to make for those enrolled in Plan 2. This can be viewed as a perk of the plan by some, a deficiency by others.

Plan 3 enrollees have choices to make.

The first choice is between a Self-Directed Investment Program or the Washington State Investment Board (WSIB) Program.

WSIB

The WSIB provides a Total Allocation Portfolio (TAP) investment option. The TAP is relatively aggressive and has a blend of investment types. Through the TAP, the WSIB can invest in asset classes that are not available to the average investor, or even the self-directed investor (explained below). It is worth noting that investors have no control over the allocation of the TAP. A 25-year-old and a 65-year-old will have the same portfolio allocation.

The TAP investment option costs 0.4792%. Meaning, if you invest $100,000 into the TAP option, the WSIB will charge you $479.20 annually. Ideally, this is more than made up for by the investment returns of your portfolio.

Always look at the cost, aka expense ratios, of your investments. Particularly when working with an advisor. It is not unusual to see fund expenses ranging above 1.00%. This is on top of any “loads” or other charges layered onto the investment.

Self-Directed Investments

If you do not want to use the WSIB TAP investment option, you can opt for a self-directed approach. Within the self-directed option you have a choice between investing in pre-determined “target retirement” portfolios that shift their allocation over time and a true do-it-yourself approach.

Target Retirement Date

The Target Retirement (One-Step Investing) approach offers investments that are aggressively allocated for younger investors, and which shift to less aggressive allocations as investors age and their retirement date approaches.

The funds provide a mix of active and passive management. Active management refers to investment funds where fund managers can choose specific companies, sectors, or countries that they expect will perform the best. Active management is typically more expensive than passive management. Passive management refers to investments that are designed to track an index, or category of investments. The goal with passive investing is to provide exposure to, for example, US Large Companies as a whole without making bets on specific companies.

Using the 2050 Retirement Fund as an example, the cost for a target retirement date fund is ~0.12%.

Build and Monitor

For those who want to take a more active role in their account, the Build and Monitor option allows you to choose from a list of funds and create the allocation that fits your needs. The investment options for this approach are somewhat limited but cover a significant number of the asset classes one might expect to find in a well-diversified portfolio.

Underlying costs for each of the funds vary between roughly 0.01% to 0.09%.

Key Takeaways

So, do you enroll in Plan 2 or Plan 3? Again, the caveat that your situation is unique and I can’t make general proclamations that works for everyone.

That said, I prefer the option that lets the stock market do the heavy lifting for retirement. Yes, there is market risk, but if you’re a new employee looking at 30+ years until retirement, time is on your side. And as retirement nears? Simply shifting your portfolio to a more conservative allocation can help you reduce the amount of risk in your portfolio. All without paying additional fees for expensive insurance products, annuities, or worse.

When would I choose Plan 2? Primarily if I was looking at a teaching career of at least five years but less than ten. This corresponds to the differing vesting schedules. If teaching will be a relatively short-lived career, I’m more interested in the plan that lets me vest in my employer’s contributions earlier.

If you choose Plan 3, there are a few next steps.

Picking a savings rate.

Personally, I’m a fan of Options B and C. Why? Because they encourage you to combat “lifestyle creep” while also increasing your savings rate over time. Win-win. Lifestyle creep is the tendency for our expenses to grow as our income increases simply because the money is there, not because needs have materially changed. Paying your future-self first is a good practice to cultivate.

Could you choose Option A? Yes, the tendency as a planner is to put as much into tax deferred accounts as possible. However, a 5% contribution might fit your budget better. If that is the case, you can plan to use the DCP or another option in the future when you can increase your retirement contributions.

Investments

Maintaining proper diversification and keeping costs low are the foundation of my investment philosophy. Increased complexity often leads to increased costs and a decreased net return, even if the pitch sounded really good.

Yes, you might be wondering, but what if my investment manager beats the market? Those costs can be worthwhile, no? Unfortunately, decades of investment research strongly suggest that your manager is just not going to consistently beat the market. They will, however, consistently charge you the same fee.

So, which portfolio to choose? The TAP portfolio is a solid option, but more expensive than others at 0.48%. The Target Retirement funds offered by the State of Washington are less complex, but also solid offerings and cost effective. I lean towards those as the best option. However, if you are managing your account in conjunction with your overall portfolio, the “DIY” approach could be attractive. In that case, you could choose to pick certain asset classes to hold in your tax deferred TRS account and gain diversification from investments elsewhere as a part of a strategy termed asset location. As a financial planner, this DIY approach is appealing to me, but it is certainly more hands-on and potentially prone to more error than the others.

Next Up

If you found this breakdown of the TRS helpful, be sure to visit once our review of the Washington State Deferred Compensation Program is up. If you have have questions that weren’t addressed or want to talk more specifically about your situation, schedule a free call with us via our “Contact Us” page. Or email me at paul@heritageroadadvisors.com. We offer 30 minute strategy calls to everyone, no commitment or follow-up required.

strategy calls to everyone, no commitment or follow-up required.