Are your TRS plan and Social Security benefits all you need for retirement?

For many, the answer is no, which means they need an additional savings plan. Enter the Washington State Deferred Compensation Plan (DCP). The DCP is a tax-deferred personal savings account that State employees can use to supplement their TRS savings plan in a tax-efficient manner.

I’ll outline below the tax benefits, contribution rules, investment options, and fees associated with the DCP. Definitely make it to the end where we take a look at the DCP’s district-based competitor, the 403(b), and provide some general thoughts on how to approach the DCP.

Tax Benefits

We start with the tax benefits of the DCP. In short, contributions to the DCP are made pre-tax and then grow tax-deferred until withdrawn.

What does this mean? Let’s say you pay taxes at a rate of 20%. If you receive $100 in pay, or “taxable income,” you will owe $20 of taxes and take home $80. Now, if you make a pre-tax contribution to the DCP, let’s say of $10, your taxable income is instead $90. You pay now pay $18 in taxes, taking home $72, and have $10 in your retirement savings account. Your tax bill is lowered.

The $10 in your retirement savings account can now grow tax deferred. In taxable accounts, if you place a trade that makes money (realize a gain) you owe a capital gains tax on that gain. If your investment pays an annual dividend or interest, you can expect to pay taxes on that income too. Not so for retirement accounts. Here, there are no taxes until you pull the money out of the account. At that point, you pay regular income tax on distributions. This is why the accounts are “tax deferred” and not “tax free.”

So how much money can you put into this DCP?

Contributions

Unlike the TRS where you get one chance to set your contribution amount, you can change, start, or stop your DCP contributions at any time. Note, though, that it can take up to 30 days for those changes to take place.

Contributions to the DCP are capped at $19,500 for 2021, there is a minimum contribution of $30/month or 1% if you can elect percentage contributions.

If you are over the age of 50, you can make annual catch-up contributions of $6,500 for a total annual contribution of $26,000.

Those approaching retirement, but not yet within three years of age 65, may have an additional savings opportunity. If you have not maxed out your contributions during your career you can make special catch-up contributions that effectively double your annual contribution limit of $19,500. This requires a phone call, and the DRS will determine the amount of special catch-up contributions you can make.

If you know someone with a 401(k) you’ll likely recognize these contribution numbers, minus the special three year catch-up, as they are the same.

And now, what do you do with the money once it’s in the DCP?

Investments

Investment options for the DCP are similar to the TRS Plan 3. Plan participants can choose between retirement date funds – 20xx Retirement Maturity Strategy Fund – or the “Build and Monitor” approach.

Target Retirement

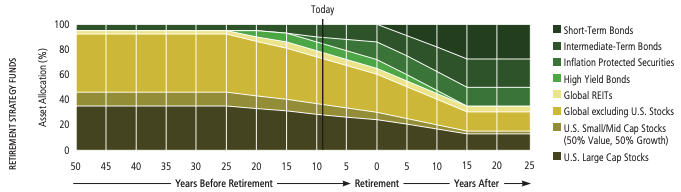

Target retirement date funds are an increasingly common option for investors. The funds are built to be more aggressive for younger investors and less aggressive for older investors. The funds rebalance automatically over time; theoretically, you could choose the fund once and forget about it until retirement. This is graphically represented below.

How do you choose your fund? Take your year of birth, add 65, then choose the fund closest to that number. Some people opt for creativity and use more than one target retirement date fund. This makes sense if you want to target a specific allocation – perhaps slightly more or less aggressive than any of the offered funds – but it can also add unnecessary complexity.

Build and Monitor

If you want more control over how your account is invested, the Build and Monitor option is for you. There are seven fund options – ranging from US stocks to international stocks to Washington State bonds – available to plan participants.

This approach is best for those who want to play an active role in keeping their accounts properly balanced. I see this primarily as an option for those with significant outside investments. For example, maybe you only want to have US stocks in the DCP and plan to gain diversification through other accounts.

What does the DCP cost?

Fees

The DCP is an excellent option for someone trying to save in a tax deferred account. There are no commissions, no transaction fees, and the investment fees are quite low.

How low? As of July 2020, the most expensive option was the 2035 Retirement Strategy Fund at 0.2831%. That includes manager fees and all other fees associated with the plan. Fees for the Build and Monitor option start at 0.1289% for US Large Cap stocks up to 0.2459% for an Emerging Markets stock fund.

To recap, the most expensive investment option within the DCP is 0.2831% of your account value. All in.

You might sense a bit of an edge here, like there is a problem. And there is.

DCP Competitor – the 403(b)

Here is the absolutely maddening thing about the world of teachers’ benefits. The NEA partners with a specific brokerage firm and markets this partnership as a way to provide additional benefits to members. This benefit is accessed through district-sponsored 403(b) accounts.

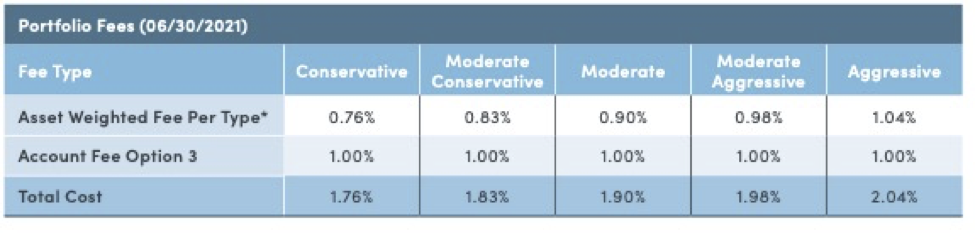

So, let’s look at the cost of that firm’s portfolios within its 403(b) accounts.

Between 1.76% and 2.04%.

Now, to be fair, I’m not comparing exactly like products here. The DCP plans are primarily index-based investment options, meaning no one is trying to beat the market. The 403(b) portfolios above have some “active” managers so one can reasonably expect them to be more expensive.

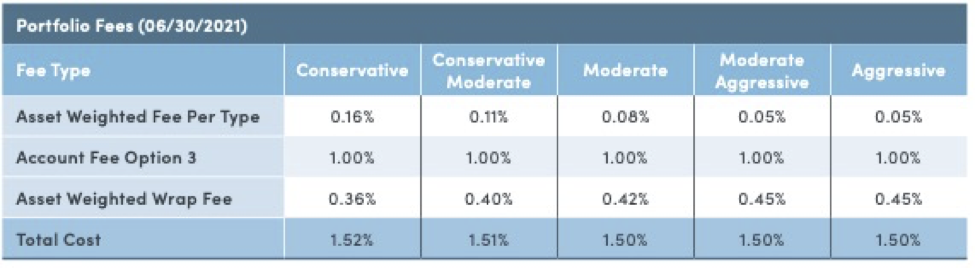

What about a portfolio focused on index-based, passive, investments?

An investor will pay at least 1.3% more than a peer using the DCP merely for the privilege of working with this firm. Should they be sold on an active, stock-picking portfolio, they could pay over 1.8% more than their peer. Every year.

The 403(b): Investor Beware

Neither the DCP nor the 403(b) plan offered by your district are 401(k) plans. There are similarities – both offer tax-advantaged savings, both are available through your employer, they have similar contribution limits – but only the 401(k) is covered by the Employee Retirement Income Security Act (ERISA). This may sound like a nuance, but it is hugely important.

ERISA regulations put a fiduciary duty on an employer to, among other things, pay only reasonable plan expenses, and to act solely in the interest of plan participants with the exclusive purpose of providing benefits to them.

Free of ERISA regulations, 403(b) accounts do not put this burden on the employer.

What happens? Investment companies can offer extremely expensive investment options. Insurance salespeople can scare teachers into purchasing annuities in their tax-deferred accounts… You get the idea. Everyone makes a lot of money, except for the teachers. Worse yet, some of these companies are invited in and provided an introduction/legitimacy by groups who, in my opinion, should be watching out for educators.

Is there a situation where a 403(b) could be an interesting idea for you? Sure – more districts are making Roth 403(b)s available and that might be compelling for your particular financial situation. And there may be a decent provider option offered amongst the Lincolns, the New York Lifes, Ameriprises, and Security Benefit Groups. But you should be crystal clear on any fees for which you are on the hook; don’t offset any tax advantage by paying sky-high fees.

If you are unsure about the fees, or if it looks like there aren’t any, ask the question again. To paraphrase my high school biology teacher, there are no dumb questions, just… people who do not ask questions.

Final Thoughts

The Washington State DCP is an excellent option for those with room in their budget to save more.

If you set your TRS contributions too low when you started working, the DCP is your next step. Even better, you can pause, increase, or decrease your DCP contributions as you see fit. This allows you to be more aggressive on your savings approach than with the TRS.

Importantly, the investment options available within the DCP are solid and relatively inexpensive. If you have no interest in investing, or want to set and forget, the target retirement date funds are your friends. If you want to be more hands on the Build and Monitor approach provides you with solid investment options. This is a solid plan that has kept investment fees low and is not trying to gouge anyone on transaction costs or other sneaky areas where firms try to gain a few extra dollars.

With that in mind, remember that insurance companies would love to have access to the funds in your DCP. You will hear arguments about the tens of thousands of investment products they can offer, the security they can provide, the abject horror of not having enough money in retirement. Remember that they have products to sell, and the commissioned salespeople need you to buy. Some might even believe what they are saying. You don’t need to help them hit their quota.

The DCP is just fine.

Have questions that weren’t addressed or want to talk more specifically about your situation? Schedule a free call with us, or email directly me at paul@heritageroadadvisors.com. We offer 30 minute strategy calls to everyone, no commitment or follow-up required.

Additional Information: