Are you ready to retire, or taking the right steps now to be ready when the time comes?

If you aren’t sure, that’s where we come in.

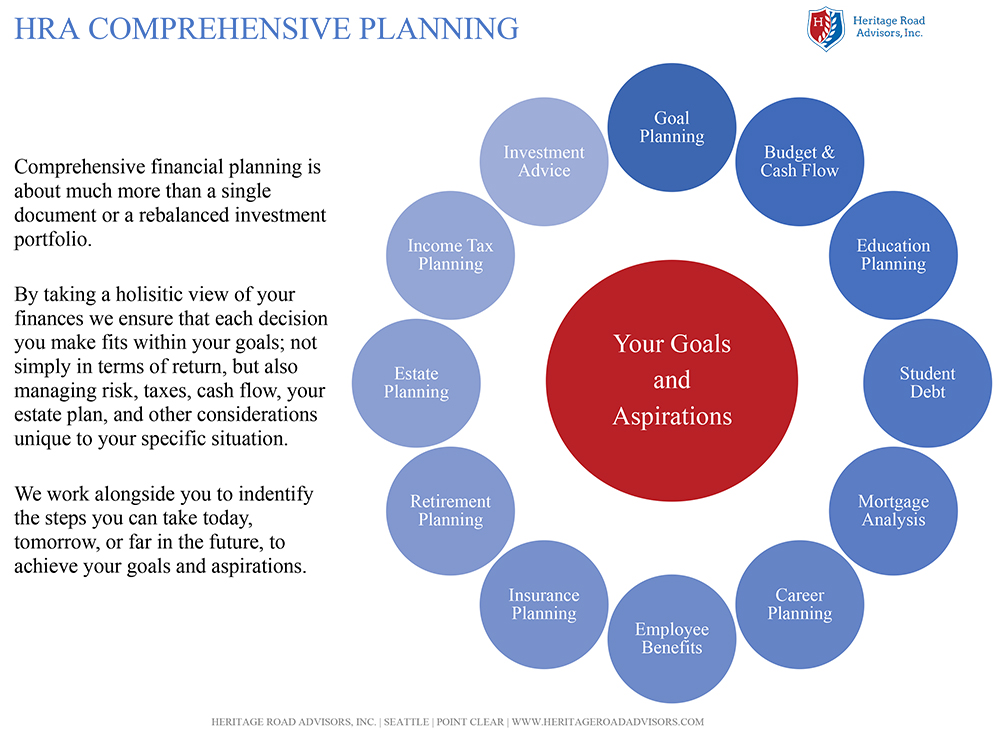

At Heritage Road, we offer both stand-alone comprehensive financial plans and investment management paired with ongoing comprehensive planning, based on what best meets your needs.

We don’t stop at retirement planning, either. We will work with you to minimize your tax burden; maximize your employee benefits; diversify and rebalance your portfolio; and more.

Whether your focus is building a strong financial foundation for your retirement years, or you are beginning to think about preserving your legacy, choosing the right way to allocate your resources – both time and financial – can be overwhelming. We’re here to help.

We work with our clients to:

- Review, Quantify, and Prioritize Goals such as retirement, educational funding, major purchases

- Analyze Current Investment Strategies by evaluating risk profile, asset allocation and diversification levels

- Review Employee Stock Awards and develop diversification plans for concentrated positions

- Review Company Benefits to ensure that you are optimizing the benefits available to you through your employer

- Provide Tax Planning to ensure that we are maximizing opportunities to reduce your tax burden

- Assess Life Insurance Coverage to determine survivor protection and beneficiary coverage

- Analyze Government Benefits like Social Security to determine your options and discuss strategies

- Analyze Corporate Pension Plans to advise on payout options and their effect on your overall plan

- Assess Estate Plans and Trusts to identify liquidity needs and tax reduction opportunities